Which Best Explains How a Budget Deficit Develops

Higher debt interest payments. To create a budget use the right method and online tools.

World Economic Situation And Prospects October 2020 Briefing No 142 Department Of Economic And Social Affairs

A budget deficit occurs when tax revenues are insufficient to fund government spending meaning that the state must borrow money usually in the form of government bonds.

. Rise in national debt. The federal governments revenue is the income it collects from taxes fees and investments. The above-mentioned is the concept that is explained in detail about balanced surplus and deficit budget for Class 12 students.

This type of budget is best suited for developing economies such as India. A spreadsheet is a good tool to use while budgeting because you can change your assumptions and see how they affect your surplus andor deficit. Nearly 60 of people say they dont track spending and 2 in 5 have never had a.

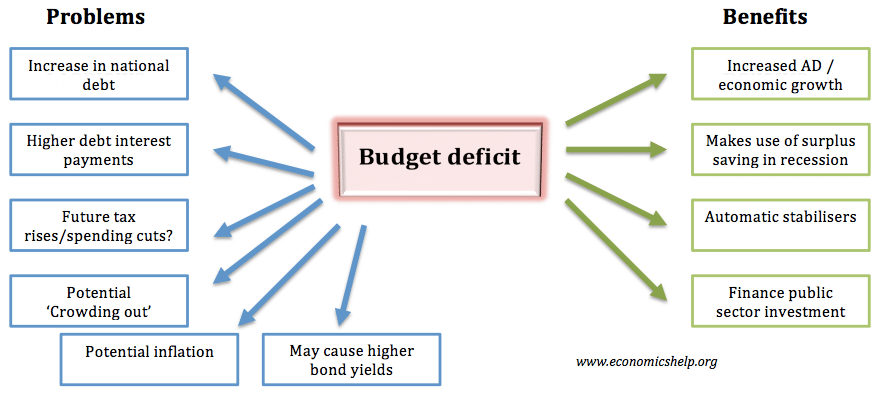

Such a budget can be implemented at times of inflation to reduce aggregate demand. Deficits are also caused from a decline in revenue due to an economic contraction such as a recession or depression. Summary of effects of a budget deficit.

The deficitsurplus is the difference between the level of government purchases and the level of receipts. 2 Contracting Economy Budget Deficit During periods of contraction or recession tax revenues could fall as earnings from both companies and individuals are expected to decline. A budget deficit is the annual shortfall between government spending and tax revenue.

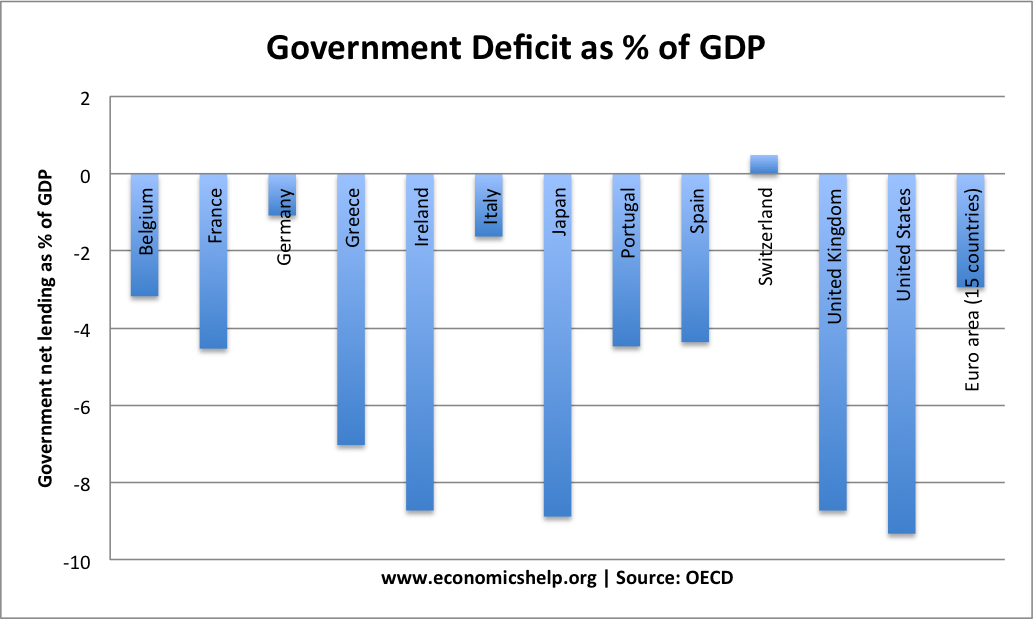

If the budget receipts are less than the budget expenditure then the budget is termed as a deficit budget. The results are typically presented as a percentage of the Gross Domestic Product GDP. There are several budget setting techniques that can be used for both expenditure and income budgets.

A key component of financial sustainability is the commitment of board and staff to financial management that includes timely review of financial reports and advance planning. During such periods the government may spend more to support companies and individuals and to stimulate the economy. The fiscal deficit represents borrowing by the government.

When spending is less than revenue it creates a budget surplus. DEFICIT BUDGET A government budget is said to be a deficit budget if the estimated government expenditure exceeds the expected government revenue in a particular financial year. Key Takeaways Governments use fiscal policy such as government spending and levied taxes.

A well-designed budget spreadsheet will have formulas pre-programmed to add. The deficit is primarily funded by selling government bonds gilts to the private sector. Get your colleagues together at the start of the year for a short QA session.

This would require the government entity to review actual spending identify opportunities to reduce expensesincrease savingsor increase revenue to balance the budget. If the net revenues were negativemeaning total expenses exceed total revenuesthis would exemplify a budget deficit. The leading deficit indicator and also the best one to measure the health of the budget in the Indian context is fiscal deficit.

There is a particular level of economic activity such. The deficit is positive when GDP is low but the budget goes into surplus when GDP is sufficiently high. One way that board and staff plan for income and expenses in the future is by creating a budget.

A budget deficit occurs when government spending exceeds revenue. The budget deficit or fiscal gap is a common scenario of almost all the underdeveloped countries across the world but the magnitude of the deficit is comparatively higher in developing countries. Budgets should accurately reflect the services being provided.

Generally expansionary policy leads to higher budget deficits and contractionary policy reduces deficits. Governments in many countries run persistent annual fiscal deficits. A government usually runs under budget surplus during economic expansions with increasing tax revenues.

In order to indicate whether the balance is a surplus or a deficit positive numbers are shown in the cases of surpluses while negative -. A budget surplus or a budget deficit is used to record the difference between national government revenues and expenditures. The best way to explain the importance of financial accountability to your colleagues is by using real life scenarios.

Approval of the annual budget is one of the fundamental building blocks of sound financial management. The budget setting process is crucial for effective budgetary control. A budget deficit often appears during recessions as the government intends to cut taxes and inject cash into the market.

These techniques can be used independently or in combination depending on the type of budget implemented. This borrowing is made by the government mostly from the domestic financial market by issuing bonds or treasury bills. The deficit is the annual amount the government need to borrow.

A government budget deficit occurs when government spending outpaces revenue.

Utilizing A Spider Map Students Will Outline Define And Explain The Domestic Policies Initiated By Nixon During Hi Presidents Lesson Plans How To Plan

The Financial Advisors Here At Lifelong Wealth Management Focus On Developing A Financial Planning Stra Financial Advisors Wealth Management Financial Planning

How Important Is The Budget Deficit Economics Help

Le Site De L Information En Images Data Visualization Data Design Information Graphics

Child Psychology And Development For Dummies Paperback Walmart Com Child Psychology Psychology Self Development Books

Nature Deficit Disorder Nature Deficit Disorder Nature Deficit Nature Education

Harvard Business Review Back Issue Oct 06 Digital In 2022 Harvard Business Review Business Leader Corporate Entrepreneurship

Which Diet Should You Follow The Real Answer Is It Doesn T Really Matter The Diet That S Best For You Is The Calorie Deficit Paleo Athlete Build Muscle

Retrain Your Brain Chartlet Gr K 5 In 2022 Growth Mindset Elementary Growth Mindset Activities Teaching Growth Mindset

6 Tips For Easy Meal Planning In 2021 Easy Meal Plans Vegan Meal Plans Meal Planning

A Timeline Of The Flint Water Crisis Infographic Flint Water Crisis Flint Water Water Crisis Infographic

Under Various Types Of Government Deficits Primarily There Are Four Types Of Deficit In India Revenue Deficit Study Materials Me On A Map Civil Service Exam

How Important Is The Budget Deficit Economics Help

Executive Function Skills By Age What To Look For Life Skills Advocate

Comments

Post a Comment